Tesla vs. Big Three (General Motors, Ford Motor Company and Fiat Chrysler Automobiles US), Tesla vs. Toyota

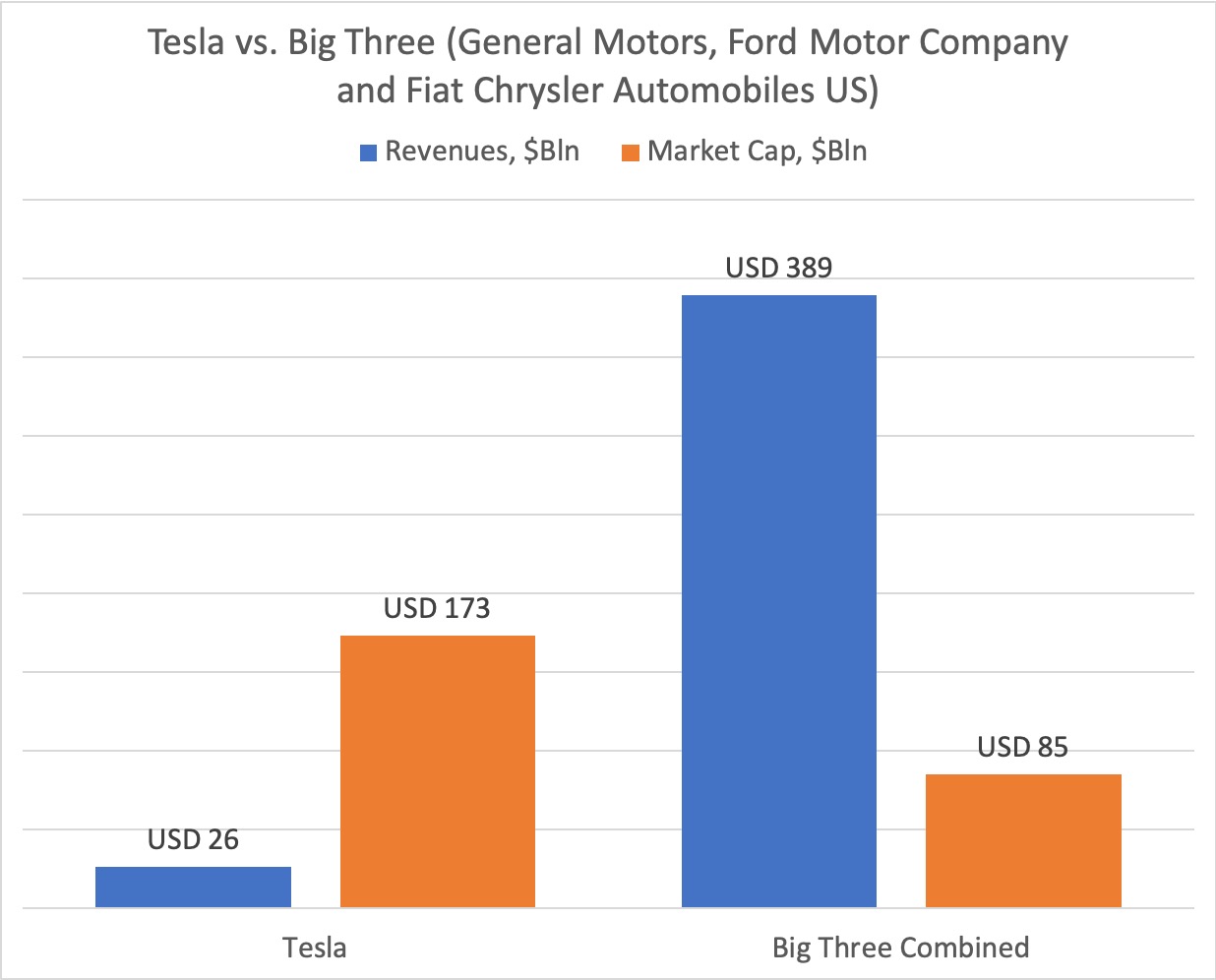

As of June 15 2020 the Tesla market cap is about two times of combined market cap of Big Three while Tesla revenues represent only 6.7% of combined Big Three revenues. The Nikola market cap is $23 Bln, about the same as Ford and Fiat Chrysler, without making any revenues at all. Tesla’s automotive revenues at about $21 billion in 2019 represent about 8% of Toyota’s $253 billion revenues while Tesla’s market cap leaves Toyota behind.

Are Tesla shares overpriced?

Are Big Three shares underpriced?

Tesla: short or long position?

Big Three: short or long position?

Nikola: short or long position?

What is the state of underlying technology behind huge valuations of BEV and Fuel Cell companies?

Will EV and Fuel Cell technologies deliver on stock market expectations?

Does Tesla’s have any sustainable technology advantage to justify high market valuation?

Tesla vs. Toyota, who is the winner?

Well-balanced automobile stock portfolio?

| Tesla | Big Three Combined | |

| Revenues, TTM $Bln | USD 26 | USD 389 |

| Market Cap, $Bln | USD 173 | USD 85 |

| General Motors | ||

| Revenues, TTM $Bln | USD 135 | |

| Market Cap, $Bln | USD 40 | |

| Ford | ||

| Revenues, TTM $Bln | USD 150 | |

| Market Cap, $Bln | USD 26 | |

| Fiat Chrysler | ||

| Revenues, TTM $Bln | USD 104 | |

| Market Cap, $Bln | USD 19 |